Some businesses use cash discounting, or dual pricing, to help offset card processing fees. Is it right for your restaurant?

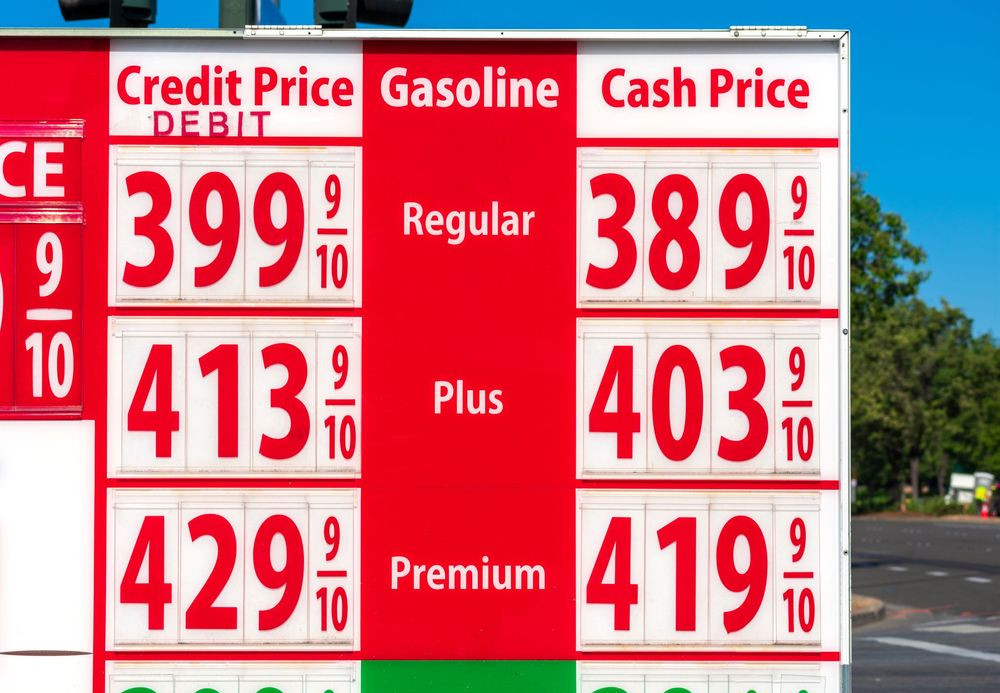

Cash discounting, otherwise known as dual pricing, is a common strategy to help offset credit card processing fees, all while giving customers an incentive to pay with cash over credit cards. While you’ve probably seen dual pricing at a gas station, with a sign with cash prices and credit card prices, other businesses can run a dual pricing program since it’s legal in all 50 states.

Even if you have the right POS system for your restaurant, how do you know if dual pricing is a good fit for your business? While some businesses benefit from equal prices for cash and credit card purchases, others might benefit a bit more from dual pricing. Before dedicating yourself to a pricing model, let’s look at how dual pricing works, the difference between dual pricing and surcharges, and other important questions to help you make the most informed decision possible.

What is a cash discount?

Cash discounts are a pricing model where a business offers a cheaper price point for customers willing to pay in cash. This pricing model is usually enforced through a payment terminal or POS device built to offer both credit and cash prices.

Even if you prefer cash purchases, you are legally obligated to advertise credit card prices to your customers. You can display credit card prices as your full price or showcase cash and credit prices, just like a gas station.

Remember, most businesses use dual pricing to lessen or offset credit card processing fees. To truly counteract credit card fees with dual pricing, you need to raise the full price on all your items. That means restaurants should update their printed menus alongside their point-of-sale system items.

What is a surcharge?

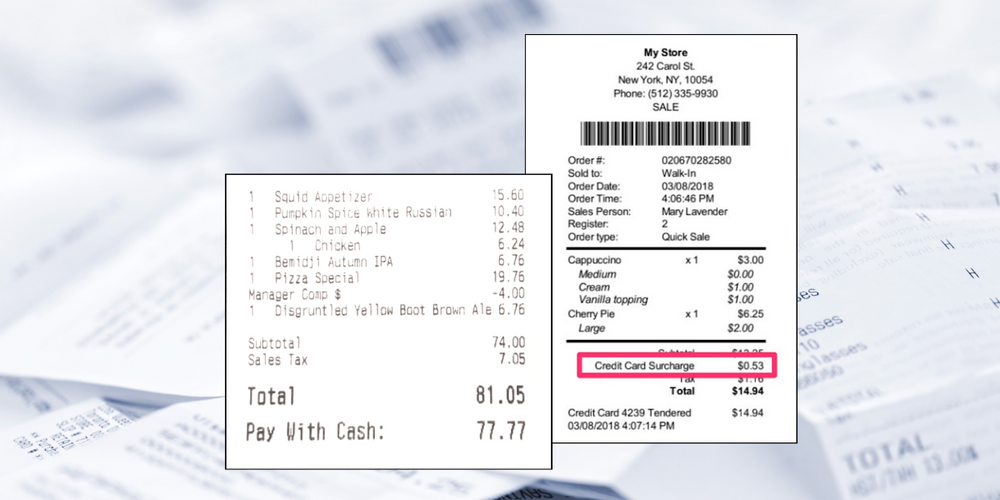

A surcharge is a line-item fee that is added on top of the normal purchase price when paying with a credit card. Surcharges allow businesses to balance out some or all of their credit processing fees by passing those charges onto the customer.

Surcharges are not legal in all 50 states. As of May 2023, surcharging is prohibited in Connecticut and Massachusetts, while Oklahoma and Colorado limit their maximum surcharge rate to 2%. Various credit card companies also have their own surcharging rules. For example, Visa lowered its maximum surcharge amount from 4% to 3% on April 15, 2023. The company requires a business to register its surcharge program through its payment processor or acquiring a bank.

Difference between surcharge vs. dual pricing

There are two major differences between dual pricing and surcharges. While surcharges are an added fee, dual pricing is advertised to the customer as a discount. While both pricing methods are designed to help offset the cost of credit card pricing fees, surcharges are more likely to be viewed as an unfair fee to your guests and scare them off.

The second difference is how the pricing is configured on your POS or payment terminal. While adding a surcharge is typically straightforward, dual pricing demands a more sophisticated configuration on your payment terminal or POS system. Instead of adding a simple extra fee, you need to program your payment device and charge the full price (aka credit card price) by default, then show a discounted price for cash-paying customers.

Best questions to ask about dual pricing

Of course, dual pricing seems very alluring, especially if you feel like you’re overpaying on credit card processing rates. However, there are some important factors to consider when exploring if dual pricing will boost or weaken your bottom line.

Do your guests prefer credit or cash?

Guest preference is the most important factor when you’re considering dual pricing. If most of your customers already pay with cash, a cash discount may be fairly successful. After raising full prices—which only customers paying with cards will have to pay—your regular cash-paying customers will pay the usual expected price. Your business will earn extra revenue from credit card purchases while your core customers stay happy.

If more customers prefer credit cards over cash, dual pricing can seem a bit unfair. This is especially true if you’re running an upscale restaurant, where dual pricing can deter your usual customers from stopping by and making a purchase. Your dedicated guests might even think your business has lessened in quality as well. Remember, your menu price points are designed to cover other business expenses like supplies, rent, and employee wages. Why shouldn’t you consider credit card prices as well?

Will you lose or gain more sales?

There have been countless studies that show consumers tend to spend more when choosing a credit card over cash. According to Fundera, 80% of consumers would rather use a credit card over cash. The same study revealed that the average non-cash transaction is $112, in comparison to the average $22 cash transaction. With the growing popularity of mobile payments like Apple Pay and Google Pay (which are charged as credit card transactions), a dual pricing plan might hinder your card-paying customers.

How much are you actually paying to your payment processor?

Always read the fine print, especially from your payment processor when looking into dual pricing plans. Of course, you’ll have higher credit card rates when implementing cash discounts. However, even if you’ve accounted for those rates by raising the full prices on your items, you’re still paying a higher price for card purchases. If you’re going to raise prices, why not negotiate the best credit card processing rate and simply engineer your menu with a moderate price increase yourself?

Will you pay more for setup from a payment professional?

The most underrated but valuable benefit of dual pricing comes from having a payment partner who will do all the heavy lifting for you. A qualified expert can help you avoid all the hassle and stress of raising prices on your own, all while making sure you have the correct signage for customers as well.

For example, with SpotOn, your local account executive can help you determine the best pricing model by assessing your current credit card rates. If dual pricing—or surcharging—is right for your business, they’ll find the best dual pricing rate and get the needed signage right away, all while ensuring your payment terminal or point-of-sale system is set up correctly. It’s meant to be easy for you and clear for your customers, all while remaining compliant.

Don’t forget that credit card processing fees are only one small piece of the puzzle. The point-of-sale is at the heart of any restaurant’s front-of-house and back-of-house operations. You’ll want flexible technology that works the way you work, backed by the personalized service and support you deserve in a technology partner.